NTD has not selected high dividend ETF, and its share price performance is surpassed by joint stocks

Taiwan Electric Power (TSMC)'s recent share price performance is not as good as its smaller rivals (UMC), mainly because TSMC failed to choose some of Taiwan's largest high-dividend exchange-traded funds (ETFs). According to Bloomberg data, NT$10.7% shares fell 3.7% this year, while NT$11% rose.

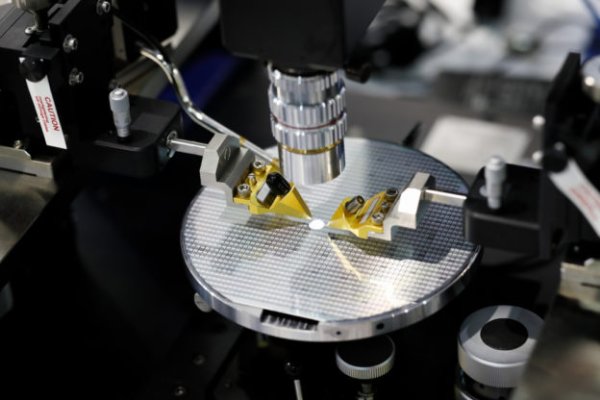

Connect's dividend yield exceeds 6%, which gives it a significant exposure among Taiwan's high-dividend ETFs, with total assets exceeding US$44 billion. Although Telco is the world's largest professional semiconductor foundry manufacturer and becomes the world's tenth most valuable company with a market value of about US$915 billion in 2025, its absence in high-dividend stock ETFs has affected its share price performance.

On the other hand, the United Nations reported stable financial results, with significant revenue growth, which enabled it to gain a good market position among value investors and could contribute to its relative advantages after NT$ was excluded. Nevertheless, TEK remains a hot stock option in the artificial intelligence and semiconductor sectors, due to its cutting-edge chip production technology and strong demand from major technology customers, but the ETF's swelling has left it behind in recent market performance.

TSMC Shares Trail Smaller Peer UMC After High-Dividend ETF Snub