SEMI: Silicon crystal may be tight, HBM transmissivity 25% is a turnover

Artificial intelligence is developing vigorously, and investment in crystalline factories continues to increase. However, silicon crystalline shipments are still stagnant. SEMI said that silicon wafers have the potential to get tired of it, and high-frequency wide memory (HBM) accounts for 25% of dynamic random access memory (DRAM), which is an important turning point in the demand for silicon wafers.

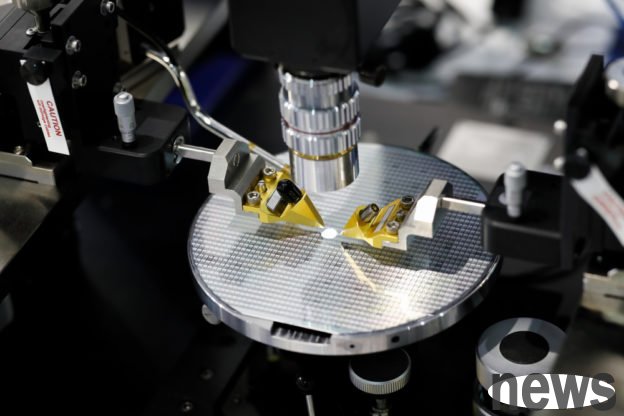

International Semiconductor Industry Association (SEMI) pointed out that the demand for artificial intelligence semiconductors is still strong, and some high-value supply chains are close to full transport. However, the shipment of silicon wafers has not been clearly reflected, mainly due to fundamental changes in the demand model of wafer wafer factories.

SEMI said that the complexity of the process is improved, the quality control requirements are more stringent, and the production speed is reduced. The annual synthesis rate of the wafer factory production cycle from 2020 to 2024 is about 14.8%. The number of silicon wafers that can be processed is limited without changing the quantity and utilization of the equipment.

In addition, since 2020, equipment expenditure per wafer surface has increased by more than 150%. SEMI pointed out that increasing investment does not mean that it can produce more energy, but rather that it will be converted to longer processing time.

SEMI pointed out that the silicon wafer surface consumed by HBM per bit is more than three times the standard DRAM, and there is a potential demand for creating huge silicon wafers. The silicon wafer market has a chance to get tight. It is estimated that HBM accounts for 25% of DRAM, which will be an important turning point in the demand for silicon wafers.