Nokia has been worn for 30 years and 10 years ago... He only spent 280,000 yuan a year, "reducing life" saved from 51 to 20,000 yuan early retirement

Getting enough pensions is a worry for many people, but without investing, how can an ordinary office worker easily get nearly 10 million apartment loans before the age of 51 and have accumulated 20 million deposits to retire early?

A Japanese office worker, Kazuma Sakaguchi, saved 100 million Japanese dollars (about NT$23.81 million) by relying on "reducing life", and in the process, he completed the loan of 40 million (about NT$9.52 million) apartment in Kanagawa, and retired early at the age of 51. Ichima Sakaguchi published the book "Save 100 million yuan, so I became a member of the company" in 2016, sharing 77 saving techniques and the concept of saving money with happiness.

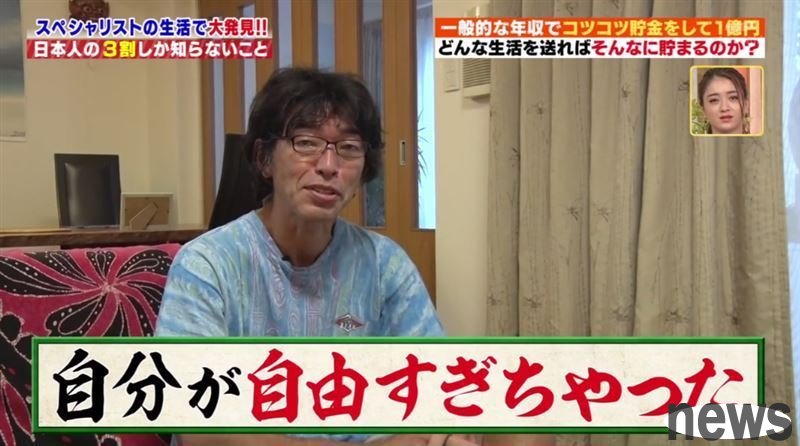

When he accepted the interview of the multi-art program, he said that his way of doing money relies entirely on simple "reducing life", not deliberately "save money", but simply implements the Buddhist philosophy of "continuing to use it if you can." It includes clothes and shoes for 20 to 30 years, and the mobile phone is also the key-type Nokia 10 years ago; the money-saving style that can be hardly saved is to limit your monthly living expenses to no more than 100,000 daily dollars (about NT$23,800).

After graduating from high school, Ichima Sakaguchi entered a technical company and climbed from a worker to a director position, but his annual salary was only about 4.5 million yen (about NT$1.07 million). Compared with the average annual salary of Japanese men, his average annual salary is 5.4 million yen (about NT$1.28 million), his income can only be considered average.

Reduce unnecessary expenses, and continue to use things if they can be used

Since the income is not large and there is no investment, how did he save 100 million Japanese dollars and pay a loan of 40 million yuan?

Sakaguchi Ichima shared that he just reduced unnecessary expenses and continued to use what he could use, such as wearing a piece of clothing for 20 years and wearing a pair of shoes for 30 years. "I just wear it because I like it, I continue to wear it."

The mobile phone is Nokia, which has been used for 10 years. It can be used online simply to satisfy my current life. Even every time I wear hair, I choose an average priced hair salon. It only costs 1,000 days a day, not to save money, but to not want to be furious by the high-end hair salon, and I don't think it's just treating myself.

Remotely from the job pressure, retire if the deposit reaches the standard

As for other daily necessities, they also adhere to the principle of "no waste". For example, the refrigerator is always empty and only choose to buy when necessary. His only "save money" is that the monthly living expenses are not exceeding 100,000 days.

Based on the annual living expenses of only 1.2 million yen (about NT$285,700) it is estimated that he can save 3.3 million yen (about NT$785,000) every year before retirement. With his pension and fixed deposit, he has been able to save more than 100,000 yen for more than 30 years of career.

Sakaguchi Ichima said that although he was in the director-level position, he had not many employees and his work ability was not outstanding. He did not want to fight for an uneasy future, so after saving for 100 million yen, he retired early at the age of 51.

However, he adheres to the Buddhist life, and his wife does not seem to buy orders. She decided to divorce when he was 56 years old. In addition, the two did not have children, so they did not have to pay any expenses, so they could retire early. But he did not consider living alone, but instead believed: "A person can no longer be free." He lived a peaceful life with free travel and volunteering.

●Original publication URL

●