Intel s privatization: Strategic solution or financial game?

In recent years, Intel's situation has been closely linked, not only its operational difficulties, but its strategic direction has also been set. Today, the US government, Silver and NVIDIA have become its major shareholders, with US holdings close to 10% of the shares, Silver holdings less than 2% and NVIDIA is about 5%. This will start the market discussion: Is there any possibility of this former "American chip giant" turning over?

Recent reports by Fortune, four former Intel board members invested in books: Charlene Barshefsky, former U.S. trade representative, Reed Hundt, former U.S. FCC chairman, James Plummer, former dean of Stanford University, and David B. Yoffie, professor at Harvard Business School. The four of them have been on Intel's board of directors for many years and have now stepped down, but have proposed a grand plan - Intel's privatization. All shares were purchased by the US government and several technology giants to remove them.

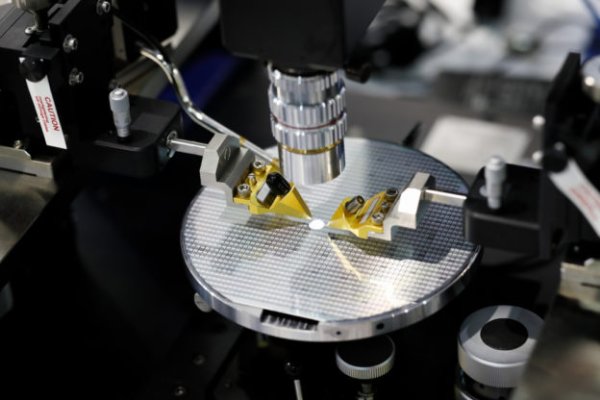

Then the main businesses are split: one company specializes in making chips and directly challenge NTF; the other company specializes in IC design and sells non-core businesses, such as self-driving mobile and investment funds. The four believed that this would allow Intel to focus on core business and attract more talents, and even create a thousand billion US dollars in return for taxpayers in the United States by 2028.

It sounds beautiful, but there are many challenges now:

1. Semiconductors can catch up with them by spending moneyThe advantages of semiconductors come from long-term accumulated process experience and supply chain trust. The technology and customer relationships established by NTU over 30 years cannot be copied by just financial investment. Even if Intel set up an independent foundry factory, it will be difficult to quickly follow if there are no large customers willing to take the risk of ordering. This is not a problem that financial operations can solve, but it takes time and long-term accumulation.

2. Disassembly may make the two sides weakerThe advantages of Intel's traditional are vertically integrated in "Design + Manufacturing". After dismantling, the manufacturing department may lose the stable support of its own design orders; the design department will directly fight against AMD and NVIDIA, and the competitive pressure will be greater. Split may not necessarily improve competition, but may instead lead to the two sides falling into bad luck at the same time, which is very different from the split case of strange companies quoted by Fortune.

3. Talent problems cannot be solved by privatizationFortune believes that after privatization, it can attract talents with high salaries, but in fact, NVIDIA can retain talents not only because of salary, but because of the leading product and clear vision. Intel's current dilemma is that its technology is lagging and lacks highlights. Privacy alone cannot prevent the loss of talent.

4. Privatization is not simple enoughFrom the current shareholder structure, Intel's main shareholders include the US government, NVIDIA, Silver and Intel itself. Just to make these shareholders reach a common understanding, there are already multiple horses. Not to mention that privatization must be approved by the board of directors and supervisory agencies, which is very complicated in operation.

In addition, privatization is often packaged into a "specialized conversion" machine, but it may actually be completely different. In the past, many companies that chose to go public had to overcome the doubts of insufficient investors' trust and valuation bubble after repackaging and then going public. There are many examples of privatization and re-listing in Taiwan, including Guojiu and Billionaire, which are the best cases of re-listing after privatization.

However, once the stock price falls after listing, it will have to bear the pressure of early funders' "receive favors"; on the other hand, private equity funds hold a large amount of funds and often regard these companies as purchases, promoting asset disposal or financial operations. This model can certainly create a short-term "exit opportunity" and allow funders and funds to take their needs, but for Intel, which has lagged its frontal process, lack of product competition, and continuous talent outflow, it may be difficult to bring a real turnaround.

At present, Intel's dilemma is not a simple financial structure problem, but is deeply embedded in the gap between technology and execution. The "privatisation + splitting" plan proposed by Fortune may create short-term highlights in the political and capital markets, but it is not easy to truly change Intel's inferiority.

What's more, the privatization process itself is full of uncertainty. It not only requires large funds to cooperate with multiple shareholders, but also faces the valuation risks and market trust challenges when relisting. Even if it is successfully delisted and reorganized, Intel will still need to spend years to refine the gap in the process and find a new breakthrough in the AI era. Otherwise, it will eventually be a "financial game" rather than a real fish turn over.

Intel Should “Go Private” and Split Into Foundry & Chip Design Units Following NVIDIA and US Government Stake, Say Former Board Members